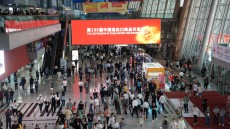

What an inviting and quality home can be like | Nina at Canton Fair

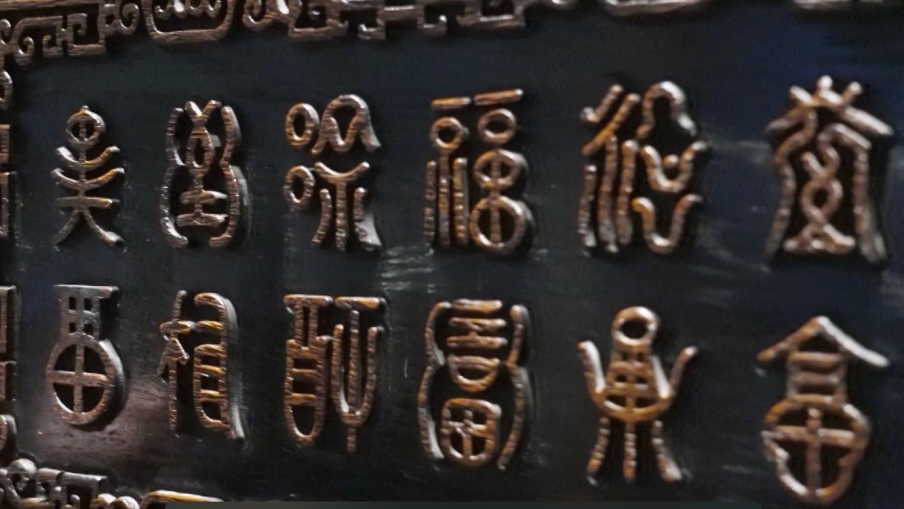

What does a five-star home look like? What products can enhance our home living experience? Join us to explore the Canton Fair and discover products to make an inviting and quality home.