In the ever-evolving world of finance and investment, few figures stand as prominently as Warren Buffett. With the 2024 Berkshire Hathaway Annual Meeting on the horizon, we invited Professor Todd Tinkle, the author of "WARREN BUFFETT: INVESTOR AND ENTREPRENEUR", to share his thoughts on the possible themes and announcements in this year's annual meeting.

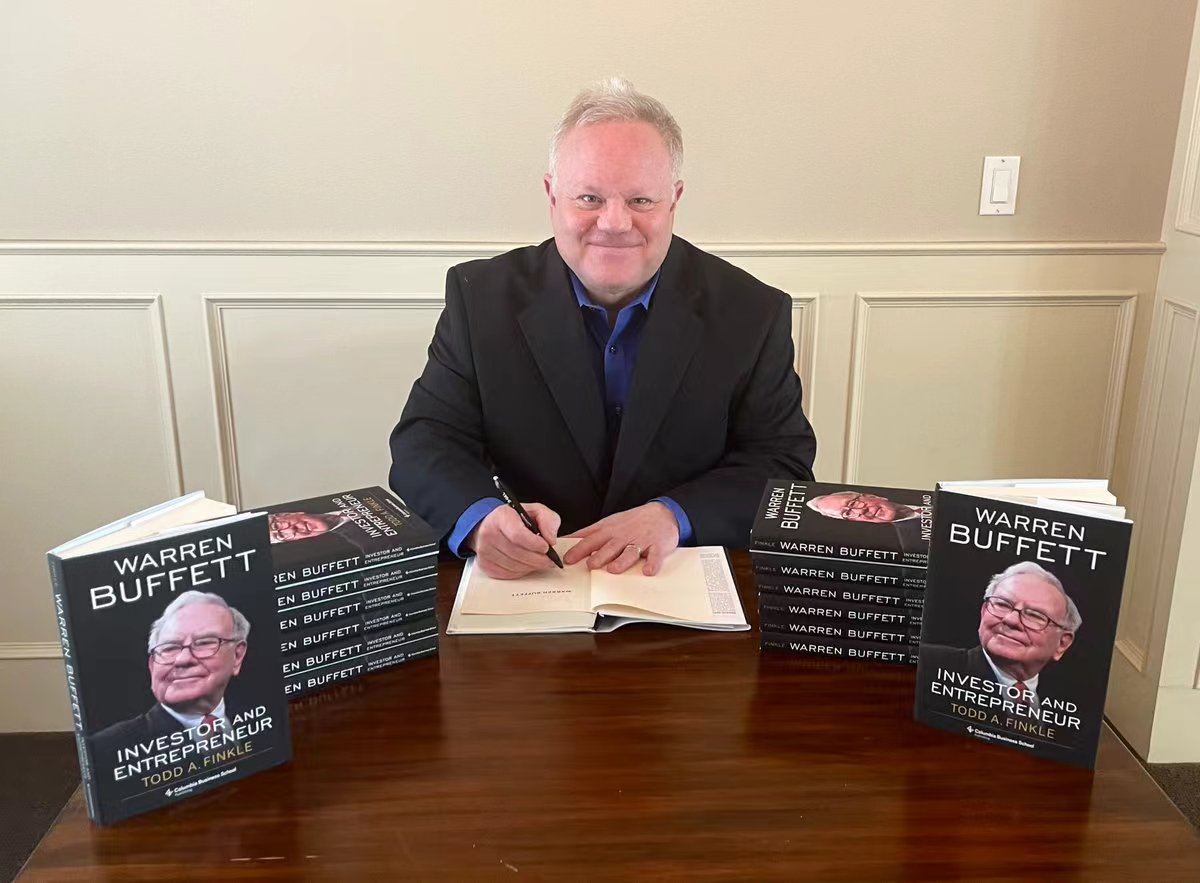

Dr. Todd Finkle is currently the Pigott Professor of Entrepreneurship at Gonzaga University. He recently won a National Book Award for his book "WARREN BUFFETT: INVESTOR AND ENTREPRENEUR", which was published by Columbia University Press) and has been translated into 13 languages.

Wall Street Frontline: What inspired you to write a book about Warren Buffett, and why focus on both his investing and entrepreneurial aspects?

Todd Finkle: I grew up in Omaha, Nebraska, and my high school years were spent alongside Peter Buffett at Central Omaha Central High School. We’d share meals daily in the cafeteria, despite him being a few years ahead. Our circle included some incredibly sharp minds – a precursor to lesson number one: Warren always advises to associate with those who are better or smarter than you, aiming to move in a more enlightened direction. Evidently, Peter took this wisdom from his father early on, joining our lunch table with what were among the brightest kids in Omaha. One peer even ascended to CEO of two public companies in Silicon Valley. Without naming names, this individual was my ride to school every day. Others in our group went on to prestigious careers and universities like Harvard, the University of Chicago, and MIT.

This cadre of remarkable individuals, including several on the math team, significantly contributed to the success surrounding Omaha Central, a sentiment Warren himself has shared with me. This school didn't just produce alumni who aided his company but was also the educational home for his children and the venerable Charlie Munger. Speaking of legacies, the Buffetts have long-standing ties with Central High; Buffett's mother was an alumna, though he moved to Washington D.C. before high school. Even his CFO is a product of Omaha Central. This speaks volumes of the institution's caliber – a breeding ground for exceptional minds, and precisely where Peter chose to spend his time.

Peter, known for his baseball cap, torn jeans, and a penchant for art and photography, also contributed to the yearbook. His affability was unmatched. That’s my initial connection to the Buffett family; my paths also crossed with Howie and Susie Buffett through family links. My departure for college and Peter’s enrollment at Stanford sets the stage for a future reconnection, catalyzed by my cousin Steve Nogg. He informed me of Warren Buffett's invitations to universities to spend a day with him in Omaha – an opportunity I grasped immediately, despite an initial rejection. Determined, I authored a case study on Buffett and finally earned an invitation for myself and 27 students in November 2009. The timing was momentous – coinciding with Buffett's acquisition of Burlington Northern Santa Fe Railroad.

Spending the day with Buffett, amidst a throng of reporters, was a testament to his dedication to teaching and engaging with students. This practice, which he continued until recently, became a personal tradition for me over nine years, bringing six student groups to Omaha. Each visit included a two-and-a-half-hour Q&A session, during which I gathered extensive notes – a foundation of primary research that would shape my writing journey. Given the plethora of existing literature on Buffett, the challenge was formidable. Yet, these experiences and reflections prompted me to ponder – should I write a book on Warren Buffett? After amassing a trove of information over nine years, I faced the pivotal decision of whether to pen a book. Everyone seemed to advise against it, yet I proceeded nonetheless, guided by the intuition that comes with being an entrepreneur. This gut feeling led me down the path of authorship, and thus, over the next five years, I embarked on the formidable journey of writing a book. It proved to be an episode rich with challenges, encompassing the navigation of agents, publishing houses, and the intricate strategies of book marketing—a complex undertaking indeed.

Wall Street Frontline: So, you have deep personal connection with the Buffetts. In your opinion, what personal traits or habits of Warren Buffett have contributed to his success?

Todd Finkle: That's a thought-provoking question. Through my research, I discovered aspects of Warren Buffett's life that were new to me, particularly his challenging childhood during the Great Depression. At around one and a half, his father lost his job, and the family fortune evaporated, plunging the household into chaos. Buffett's mother, suffering a nervous breakdown, resorted to verbal abuse, calling young Warren worthless—a kind of trauma that could have long-lasting effects. However, Buffett channeled this adversity into an early start in entrepreneurship, setting up a lemonade stand at age 4. He then pursued a variety of ventures, driven by an innate hunger—not for money, but for success. By age 10, he knew he wanted to be an entrepreneur, determined not to toil in manual labor as he had in his grandfather's grocery store.

This hunger and drive shaped his entrepreneurial aptitude. I often tell my students about Buffett's belief that the most successful businesspeople are those with extensive business experience who think outside the box. It's a message I emphasize, encouraging them to go beyond academic achievements and to 'make it happen.'

A prime example of such entrepreneurial spirit is Mrs. B, who started working in a store in Belarus at 6 and managed 10 employees by 16. Seeking freedom, she left Belarus alone, offering a bottle of brandy to a border guard to secure her passage. Eventually, she reached Omaha, Nebraska, where, despite not knowing English, she turned $500 into the largest private furniture store in the U.S., later sold to Buffett for $55 million. Buffett often speaks of Mrs. B, who learned English from her children attending grade school, as an embodiment of entrepreneurial success despite significant barriers.

Buffett's honesty, integrity, and persistence have been integral to his success. He continually acknowledges his mistakes, has an impressive IQ and EQ, and exemplifies the importance of perseverance. After years of persistence, he eventually worked for his Columbia University professor, Benjamin Graham, and became a millionaire by 25. These stories and lessons from Buffett's life and the experiences of others like Mrs. B have profoundly influenced my understanding of what it takes to succeed, and they are the kind of insights that fill the pages of my book.

Wall Street Frontline: You mentioned that Warren Buffett started doing business since he was a child. How do you think Warren Buffett’s investment philosophy has adapted to the current market environment, which is quite different from when he started investing many years ago?

Todd Finkle: Warren Buffett, traditionally known for his aversion to tech investments, surprised many when in 2016 he ventured into Apple, which now constitutes half of his stock portfolio. This significant pivot to technology raises discussions about the future of Apple, especially considering shifting production from China to India, and its sales impact. Buffett's investment strategy, famously characterized by a long-term hold approach, seems at a crossroads with these developments. In my book, I delve into Buffett's investment in Apple, providing a comprehensive section on valuing the tech giant. One of the book's highlights is the step-by-step real-world example of company valuation. I dissect financial and qualitative metrics using the discounted cash flow method, coupled with a sensitivity analysis for various scenarios.

This analysis echoes Buffett's investment philosophy of purchasing quality companies, a strategy influenced by Charlie Munger, advocating for investments in excellent management at fair valuations coupled with patience. Contrasting with today's average investor who holds a stock for merely six months, Buffett's approach underscores the importance of a company’s 'moat'—whether in brand, IP, or cost structures—and the quality of its management. Does the management own shares? Are they independent thinkers or followers? Above money, their passion for and belief in the company is paramount, an ethos Warren Buffett values greatly. This passion, beyond monetary gain, is essential, and for those aiming to work with Buffett, showing a genuine love for Berkshire Hathaway could be the key.

Wall Street Frontline: What are your expectations for the 2024 Berkshire Hathaway Annual Meeting in terms of major themes or announcements? What key messages do you think Warren Buffett will emphasize in this year’s meeting, especially considering the current economic climate?

Todd Finkle: The forthcoming Berkshire Hathaway meeting is poised to place a spotlight on Charlie Munger, a figure synonymous with the company's legacy. Each year, a film, approximately 45 minutes long and produced by his daughter, adds a touch of humor to the event, often featuring Charlie charmingly alongside a younger female co-star. This year, it wouldn't be unexpected to see a compilation of these moments as a tribute to him. There will undoubtedly be inquiries on how the company is faring without his presence, along with discussions around Warren Buffett’s viewpoints on Apple, given its sizeable role in the portfolio. Additionally, a review of the annual reports, dating back to the days of Buffett’s partnership, will offer insights akin to an advanced course in investments.

Last year's financial hit to Buffett’s railroad interests with BNSF and the energy sector, partly due to the wildfires in the western United States, is sure to raise questions. This concern is amplified by Berkshire's status as an insurance company, potentially facing billion-dollar settlements linked to these fires. Another serious subject is the national debt and unfunded liabilities, figures which Buffett and Munger have previously highlighted and expressed concern about.

The meetings are an opportunity to delve into these pressing issues, in an environment where Warren Buffett's words resonate with quiet authority. The dynamic that Charlie brought to the meetings will be sorely missed this year. Their interplay, reminiscent of the comedic rapport of Laurel and Hardy, brought levity to the serious business of investment and company strategy. His legacy, undoubtedly, will be acknowledged and felt throughout the meeting, marking the first year without his direct contribution.

Source | SFC