On January 4, PwC released a data review of initial public offering (IPO) performance in the Chinese Mainland and Hong Kong in 2021, along with its outlook for 2022, showing that the number of IPOs and total funds raised in 2021 increased compared to 2020.

The number of IPOs

A-share IPOs set new records in terms of volume and value in 2021

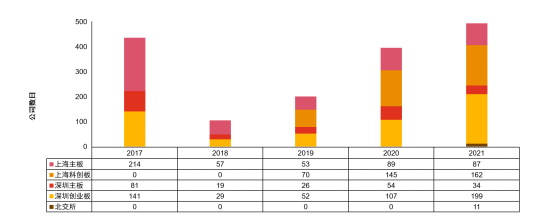

There were 493 new listings and RMB 547.8 billion in funds raised with an increase of 25% and 17% respectively, both reaching record highs. The Shanghai Stock Exchange was one of the world's top three IPO markets in 2021, with a total fundraising of RMB 375 billion for 249 listings, ranking it behind the Nasdaq.

In 2021, 73% of A-share IPOs were issued through the registration system, accounting for 65% of funds raised. There were 199 IPOs on the Shenzhen ChiNext and 162 on the STAR market– the top two boards for listings. The STAR market accounted for the most funds raised with RMB 206.2 billion. November 2021 saw the opening of the Beijing Stock Exchange – 11 shares were listed on the new bourse, with a fundraising of RMB 2 billion.

"The full implementation of the registration system will benefit the A-share market. Driven by the continuous growth in new shares on the STAR market, Shenzhen ChiNext and Beijing Stock Exchange, we expect to see 580-690 A-share IPOs and a record high of RMB 560-635 billion in fundraising in 2022," said Thomas Leung, PwC China Markets Managing Partner.

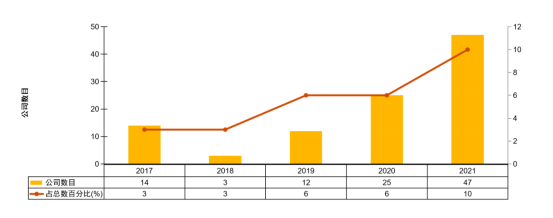

In addition, carbon neutrality and long-term sustainable development have garnered increasing attention in the global economy. More and more investors are favouring companies with a clear Environment, Social and Governance (ESG) mission. In the A-share market, the number of ESG-related IPOs increased to 47 in 2021, or 10% of the total.

More and more investors are favouring ESG-related companies

"2021 has been an important year for reform of the A-share market. It was the first full year for the pilot registration system on the Shanghai and Shenzhen Stock Exchanges, as well as the founding year of the Beijing Stock Exchange. The reform of stock issuance following the revision of the Securities Law has significantly improved the efficiency of IPOs," said Jean Sun, PwC China Firmwide Corporate Services partner.

Hong Kong market forecast to further thrive in 2022

In 2021, there were 99 new IPOs in the Hong Kong market, 98 of which were listed on Main Board that mostly comprised retail, consumer goods & services (54%), and financial services (19%).

The Main Board IPOs decreased by 33% in number of listings compared to 2020. Total funds raised by IPOs in 2021 reached HK$331.66 billion, marking a decrease of 17% from the previous year.

In 2022, the New Economy and U.S.-listed Chinese enterprises are expected to remain the key drivers for listing activity on the Hong Kong Stock Exchange (HKEX). As Asia's biggest biotech fundraising hub, listing of biotech companies in Hong Kong is also expected to remain active.

Meanwhile, increased demand from investors and stricter regulatory requirements will drive more listings from renewable energy, electric vehicle and other sustainable and ESG-related businesses.

With the new rules on special purpose acquisition companies (SPACs) issued by the HKEX, it is expected around 10 to 15 SPACs will list in Hong Kong this year, raising HK$20 to 30 billion. PwC forecasts 120 IPOs in 2022, with total funds raised between HK$350 and 400 billion. This could place Hong Kong among the top 3 fundraising markets in the world in 2022.

Author | Holly

Editor | Olivia, Monica, Jerry