China saw stable economic growth in 2021, the profitability of banking industry rebounded significantly and had further support for the real economy, according to the latest report about China's banking development released by PwC on April 20.

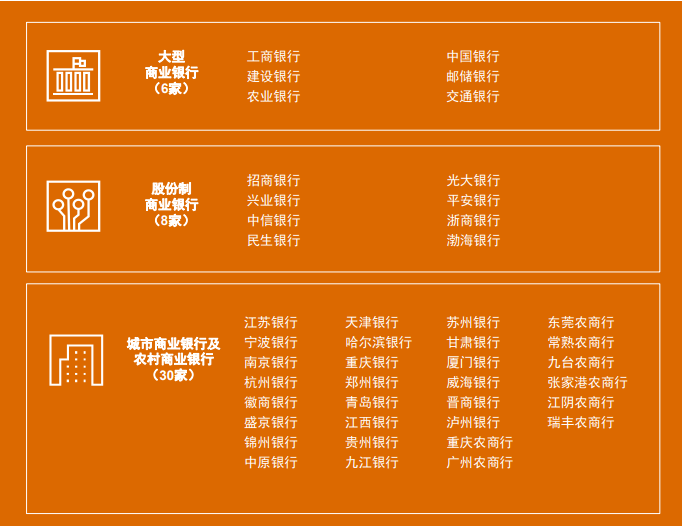

The report analyzes full-year performances of 44 A-share and H-share listed banks in China by the end of December 2021. These banks own 74.54 percent of the total assets and 83.73 percent of the net profit of all commercial banks in China.

The report also shows net profit of the 44 listed banks increased by 13.06 percent year-on-year to 1.83 trillion RMB.

In detail, the six large commercial banks including the Industrial and Commercial Bank of China and the Bank of China achieved a net profit of 1.29 trillion RMB, a year-on-year increase of 11.43 percent. Net profit of joint-equity commercial banks and urban & rural commercial banks also increased 17.53 percent and 16.11 percent, respectively.

The robust growth of the listed banks' net profit was due to a year-on-year decrease in the provision for impairment losses on credit assets, and the increase in non-interest income, said Michael Hu, the finance partner of PwC China.

By the end of 2021, the total liabilities of listed banks were 195.99 trillion RMB, with an increase of 7.62 percent from the end of 2020, which shows the liabilities grew on a steady scale. In terms of liability structure, over 81 percent of their liabilities are deposits, and the proportion of deposits from large commercial banks is significantly higher than that of other banks.

Facing the uncertainties brought by pandemic, financial market volatility in 2022, the banking industry should make proper adjustments and structural management in flexible ways, said James Chang, China Financial Services Leader, PwC China.

Author: Will

Editor: Wing, Olivia, Jerry