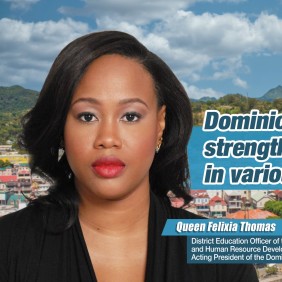

Canton Fair Talk | What do overseas buyers think about Chinese economy

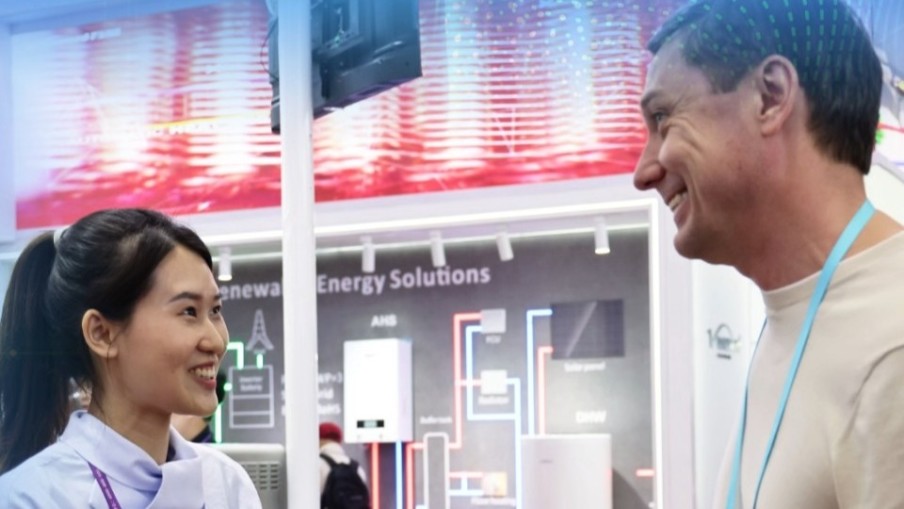

"Shrinking", "lower", "slump","fragile", these are always the key words in Western media's reports about Chinese economy. Western media have long painted a bleak picture of China's economy, with negative news stories flooding the headlines, ls it truth or malicious smear? Join us at the 135th Canton Fair, where overseas buyers, directly impacted by the Chinese economy, share their opinions.