Amid a turbulent global trade context triggered by increasing protectionism in the US, going overseas has become a strategic option for enterprises based in the Guangdong-Hong Kong-Macao Greater Bay Area (GBA).

During the Greater Bay Area Master Class held by the University of Hong Kong (HKU) Business School Shenzhen Campus recently, Cliff Chau, managing partner of Ewpartners, an international investment firm focusing on bridging Asia and the Middle East markets, shared his insights on the South GCC countries' role in global supply chain rebalancing, the collaboration potential between the GBA and the Gulf Cooperation Council (GCC), as well as the advantages and challenges for GBA firms expanding into the Middle East.

Cliff Chau receives an interview with South in Shenzhen on August 1, 2025. (South Photo)

GCC --- the focus of global supply chain rebalancing

Comprising six Arab nations bordering the Persian Gulf, including Saudi Arabia, Qatar, and the UAE, the GCC has become the focus of global supply chain rebalancing due to various internal and external reasons, according to Chau's analysis.

Internally, GCC countries are undergoing an economic diversification due to the unsustainable growth model reliant on fossil fuels. National strategies such as Saudi Vision 2030 aim to diversify their growth models.

To accelerate this process, it is beneficial to adopt a "borrowing" approach to welcome advanced productivity from other countries, which can enhance relative industries without starting from scratch.

Additionally, while GCC countries are rich in resources, sovereign wealth funds, and foreign exchange reserves, they face a relative shortage of talent. Therefore, Chau concluded that leveraging the technological strengths of major powers and introducing new economic productivity are a viable option for their economic development.

Externally, GCC countries, as Chau observes, seek to position themselves as a middle power in the global geopolitical landscape, driven by regional economic collaboration with the US, ASEAN, and China.

US President Donald Trump's Gulf trip in mid-May this year resulted in over $2 trillion in deals with Saudi Arabia, Qatar, and the UAE in sectors such as AI, aviation, and energy.

As Chau pointed out, Trump's "drill baby drill" policy indicates that leveraging American oil is essential. Given the large oil reserves of Gulf states and OPEC, the primary mechanism for global crude oil pricing, Chau projected that the region would likely be relatively spared from tariffs, leading to a more stable, low-tariff environment in the medium to long term.

"This presents an opportunity for firms considering supply chain rebalancing as they seek regions with more competitive tariffs to rebuild their manufacturing capabilities and supply chains," he added.

ASEAN countries also stand out for their collaboration with GCC countries due to their cultural proximity and abundant petroleum resources. Chau noted that countries such as Malaysia and Indonesia have large Muslim populations. GCC countries, dominant in onshore oil, and ASEAN countries, dominant in offshore oil, both aim to diversify their development with a shared goal.

Above all, Chau highlighted that China maintains solid diplomatic relations with Belt and Road countries, including ASEAN nations and Gulf states. He expressed high hopes for the ASEAN–GCC–China Summit in late May and sought to explore potential areas of cooperation among the three parties.

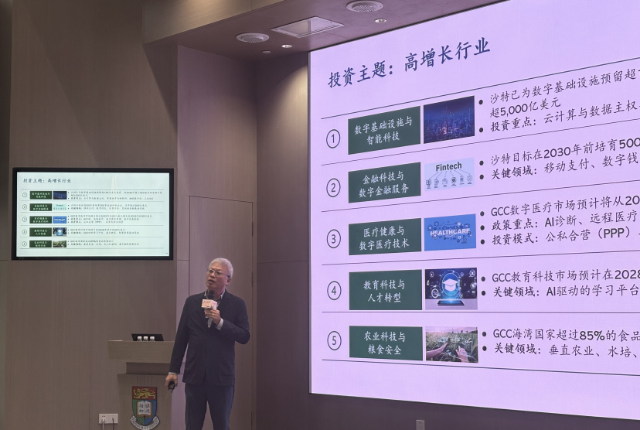

In this context, GCC countries are currently focusing on various industries in China and welcoming enterprises to develop their businesses in the Middle East. Regarding high-growth sectors in Gulf states, Chau listed five options for Chinese firms: digital infrastructure, fintech, healthcare, education, and agri-tech.

Cliff Chau delivers his lecture based on routes for Chinese firms going overseas in the GCC countries in Shenzhen on August 1, 2025. (South Photo)

The collaboration between GBA and GCC

As China's primary gateway to the world, Hong Kong SAR can play a crucial role in bridging China and the Middle East, as Chau observes.

As a super connector, Hong Kong possesses institutional advantages, talent, taxation benefits, intangible asset protection, and arbitration institutions. These advantages can help mitigate the adaptation gap faced by Chinese firms expanding overseas, with some firms adapting in Hong Kong first.

Moreover, Hong Kong has substantial fiscal power with considerable foreign exchange reserves, which support the USD/HKD-linked exchange rate and serve as a tool for preserving and increasing investment value.

To connect China and GCC countries, Chau proposed that Hong Kong SAR could leverage its capital resources effectively. Capital involvement can encourage Chinese firms to select Hong Kong as a base for further expansion and enhance its role in the global value chain. Over 200 firms have lined up for IPOs in Hong Kong so far this year due to its offshore financing capabilities supporting the global development of enterprises.

The Greater Bay Area, with its population of over 87 million, offers a broad industrial and innovation base, while Hong Kong's population of around 7 million supports its positioning as a high-value international hub. Together, they form a complementary ecosystem for global expansion.

For example, Shenzhen has developed numerous smart manufacturing firms in recent years, ranging from speakers and headphones to smart home technologies such as robots.

Notably, Saudi Arabia's Public Transport Authority officially launched its first 12-month autonomous taxi pilot program in Riyadh, covering seven core areas in late July this year. The dominant technology is led by automobile manufacturers in Guangzhou, WeRide, and GAC.

In this vein, Chau sought to explore how to create synergy between Hong Kong SAR and the mainland cities in the GBA. He suggested that capital in Hong Kong should serve as a pilot to expand into GCC countries. Firms in the GBA, along with their enterprise ecology and scientific research capabilities, should align more effectively with the capital offered by Hong Kong.

Cliff Chau highlights high-growth sectors for investments in GCC countries in Shenzhen on August 1, 2025. (South Photo)

Opportunities & challenges for GBA firms to expand in the Middle East

The economic growth rate is projected to be 3.2% in 2025 and 4.5% in 2026. GDP per capita ranges from $20,000 to $79,000 among GCC member countries, and industries are on the verge of flourishing. Chau expressed high expectations for GBA firms to expand into the Middle East.

As the former Managing Director and Head of the Finance Department of China Investment Corporation, a Chinese sovereign wealth fund (SWF), Chau focused on the accessibility of SWFs in GCC countries for GBA firms.

He explained that as patient capital, SWFs inherently prioritize long-term investment strategies. Due to geopolitical dynamics, SWFs are no longer solely focused on financial returns; they can also be used to revitalize national economies, complement national economic strategies, and promote economic development. This trend is increasingly evident in the Gulf states.

Nonetheless, challenges such as cultural differences and production costs remain, as Chau warned. He advised GBA firms to approach these issues with a more mature mindset.

He elaborated that firms are often overly enthusiastic about financing. It may not be as straightforward as they anticipate. Entrepreneurs, accustomed to diverse government support policies in China, may assume that similar policies will be replicated or even improved in GCC countries. "This can be a misconception," Chau added.

Reporter: Zhang Ruijun

Photo: Zhang Ruijun

Editor: Yuan Zixiang, James, Shen He

Wang Yating (intern) also contributed to the article.