According to PwC's "Global Entertainment and Media Industry Outlook 2021 to 2025" China Summary, it is estimated that the total revenue of China's entertainment and media industry in 2021 will be approximately US$358.6bn and reach roughly US$436.8bn by 2025. In the next five years, China’s compound annual growth rate (CAGR) of 5.1% will be higher than the global rate of 4.6%. Among them, China will lead the world in average revenue growth in segments such as Virtual Reality (VR), OTT video, and Internet advertising.

Internet advertising

The rapid development of 5G+ Internet of Things (IoT) has propelled the growth of internet advertising. It is estimated that by 2025, China’s internet advertising revenue will reach approximately US$117.5bn, with 10.1% CAGR. Notably, mobile spending is on course to dominate the growth of internet advertising in China, with its share of total internet advertising revenue increasing to 66% by 2025. Live video, being one of the most prevalent market segments, and the major application for Internet users, will continue to grow in the future.

For China's entertainment and media industry, the interconnection of everything and data-driven, personalized service systems enabled by 5G+ IoT, are popularizing the application of virtual reality and smart home technologies, creating a more solid foundation for digital marketing, and an effective way to deliver media experiences to consumers. In the future, we can expect users to be provided with a wide range of marketing pushes, and live broadcasts of high-quality content will be the driving strategy of enterprises to gain market share.

On July 13, 2021, China Internet Conference opened in Beijing.(Xinhua/Li Xin)

Video games and Esports

China is the world's largest video game and esports market. Total video games and esports revenue reached US$31.5bn in 2020, and is forecast to increase at a 4.99% CAGR to reach US$41.7bn from 2021 to 2025. Among them, the CAGR of video games in China will be 4.9%, while the growth rate of esports will be 12.3%. Over the same period, the revenue share of app-based social/casual games to total video games in China is predicted to reach 71.8%, and the revenue share of China’s esports media rights and sponsorships to total esports is estimated to reach 75.1% by 2025.

In 2020, the scale of China's overseas gaming market increased by 33.25% year-on-year. In the future, the potential of overseas market is still huge, and the driving force of launching video games overseas will become a major revenue-driver for platform operators.

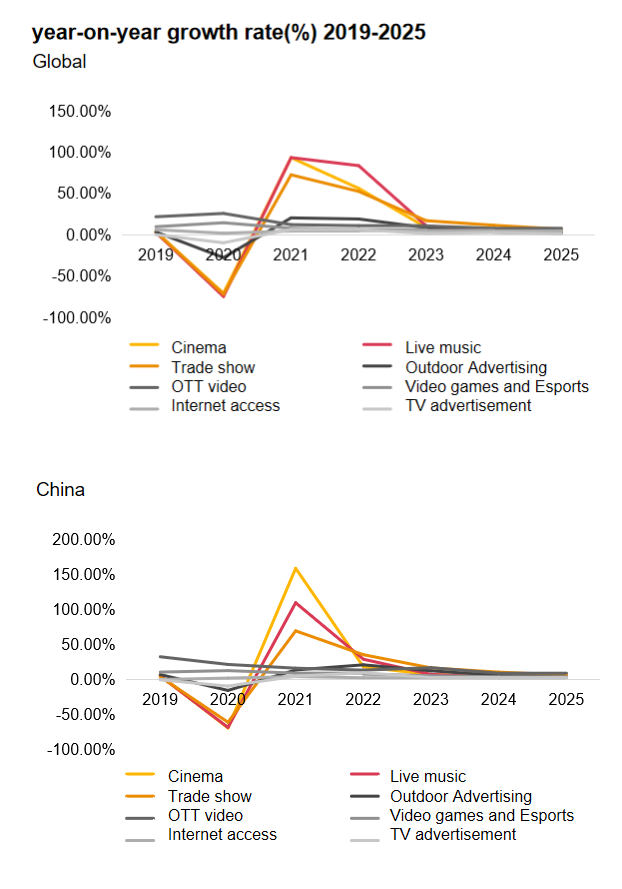

Cecilia Yau, PwC Chinese Mainland and Hong Kong Media Leader, stated, “China's entertainment and media industry is recovering faster than the rest of the world. In the next few years, with the lasting impact of the pandemic and continuous innovation of technology, as well as fierce competition in China’s entertainment and media industry, it will undergo tremendous change. Virtual reality and OTT video are expected to continue to grow in popularity, increasing their share of market revenue.”

Cinema

Due to the impact of the pandemic, the number of people going to cinemas in China plummeted in 2020, but the industry has recovered well overall. By December 2020, box office revenue had returned to US$2.9bn, returning 92.4% of the level in the same period of December in 2019 (US$1bn), as a result of the early control of the pandemic. The number of moviegoers has also rebounded sharply to reach about 1.4 billion in 2021, and forecast to be 1.8 billion by 2025, exceeding pre-pandemic levels. In terms of revenue, China and the United States are still the world’s two largest movie markets.?China’s film revenue in 2025 is expected to account for 23.5% of the world's total revenue of US$47bn, second only to the United States'24.1%.

Jensen Wang, PwC Chinese Mainland Entertainment and Media Partner, noted: "Looking ahead, Sino-foreign cooperation in film making will continue to flourish, becoming the major future development trend for China's film industry. Additionally, with the rapid development of new technologies in VR/AR, artificial intelligence, and biotechnology, the sci-fi film industry will continue to advance, propelling sci-fi films to rank amongst the most popular genres."

A movie theater in Shenzhen reopened after the pandemic.(Nanfang Daily/Lu Li)

OTT video

China's OTT (over the top, meaning over internet) video market continues to develop. It is estimated that the CAGR from 2021 to 2025 will be 11.86% to reach US$17.3bn in revenues, which is faster than the global growth rate. Driven by multiple factors including a range of media outlets expanding their breadth and increasing the richness of their content through various means such as original content creation and ecosystem cooperation between platforms. In the future, we can expect different interfaces to be integrated to provide rich and personalized experiences.

Cecilia Yau, PwC Chinese Mainland and Hong Kong Media Leader, also highlighted that, "Emerging macro trends and consumption habits arising from the pandemic have led to changes in consumer behaviours. Consumers are gaining more power as they now watch more content such as new movies, live webcasts and online concerts through OTT video platforms, diversify their consumption scenarios, and attract a large number of new audiences through user-generated content."

Click to get the report: Global Entertainment and Media Outlook 2021-2025

Author | Alice

Editor | Olivia, Jerry