(Source: Nanfang Plus)

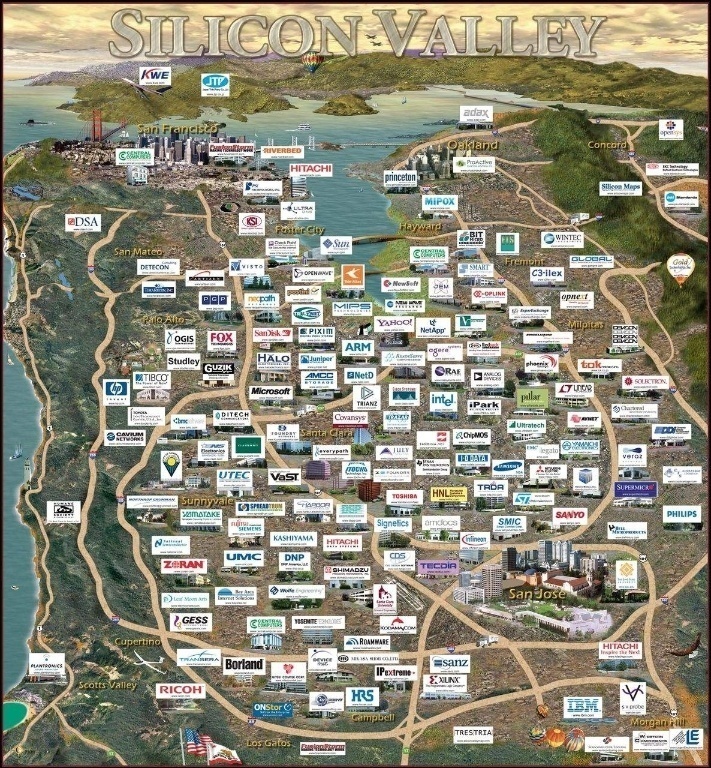

As the core city of the California Bay Area, San Francisco has grown as one engine driving the US’s technological innovation. Silicon Valley, the industry core of San Francisco and also a global innovation center, has witnessed its venture capital firms, alliances between universities and industries and innovative companies clusters combining and intermingling to form a special innovative ecosystem.

China’s Guangdong province is similarly driving toward developing the Guangzhou-Shenzhen Science and Technology Innovation Corridor, aiming to make itself the nation’s major innovation engine and gateway for the province to connect to global innovation trends. Last year the province carried out policies of encouraging innovation and entrepreneurship, development of SMEs and venture investment, aiming to optimize the province’s business environment.

This March, journalists from Nanfang Daily, one Guangdong’s leading media publications, were sent to the US, UK, Germany, Singapore and other international financial hubs and had conversations with experts there, attempting to explore experiences that the province can learn from.

Organized by Xie Sijia, Liu Jiangtao, Xie Meiqin, Luo Yanjun, Zhang Ying, Huang Qianwei

Reported by Peng Lin, Huang Qianwei, Guo Jiaxuan, Tang Liuwen, Tang Zitian, Zhang Jun, Long Jinguang, Hu Nan

Edited by Olivia Ouyang, Simon Haywood

Chinese Version please click:

(Source: Nanfang Plus)

Bring in innovation funds to guide industrial development

Prof. Zhang Xiaojun of Haas School of Business, University of California, Berkeley suggested that Guangdong could develop a unique financial ecosystem with its advantages in the manufacturing industry and its location in the Greater Bay Area, rather than simply being a copycat of Silicon Valley.

“Guangdong is dominant in traditional industries, logistics and marketing. It’s a wrong thinking that the traditional industries are out of time. Combining the traditional industries with modern developing methods would accelerate the process of the province’s development,” Prof. Zhang said.

Additionally, Prof. Zhang indicated that Guangdong could trial some preferential policies regarding innovation funds to guide the province’s industrial development.

Increase number of agencies to invigorate the market

Wang Baolian, the Assistant professor of finance from the Gabelli School of Business in Fordham University, also proffered his solutions.

“Stock exchanges, NEEQ and regional equity exchange are all of great importance to innovation and the development of high technology,” Wang advised that stock exchanges should quicken their paces on innovation and grading, while efficient regional equity exchanges should be developed, which can tremendously help companies increase financing channels and speed up VC’s quit.

At present, small companies dominate China’s regional equity exchanges. However, due to weak disclosure of companies’ information, the size of exchanges and market development are greatly influenced. Wang proposed that the province can turn on green lights to more agencies to activate the market.

“For instance, we can introduce more market makers to perform trade marching. Gradually they will become market experts, who can both get hold of information and more evenhandedly consider the interests of buyers and sellers.”

Grey Becker, the Chief Executive Officer and the President of Silicon Valley Bank (Source: Nanfang Plus)

Give innovative companies freer reign over bank loans

Grey Becker, the Chief Executive Officer and the President of Silicon Valley Bank, believed that traditional credit’s policies to support innovation can be further optimized. For example, simplify the approval and distribution process of loans for innovative enterprises. Becker is among the foreign pioneers in China’s innovation market.

“In the US, companies can get 5-10 million USD loans directly from the bank and they are given free reign over the money.” Becker suggested that Guangdong could trail to give innovative companies freer reign over their bank loans.

“If you want to promote innovative technology more efficiently, you should go off the beaten track and implement new policies that are exclusive to creative companies, making them grow faster.” Becker remarked.