I SEE CHINA|Italian student visits Canton Fair Phase Ⅱ and reunites with her classmate

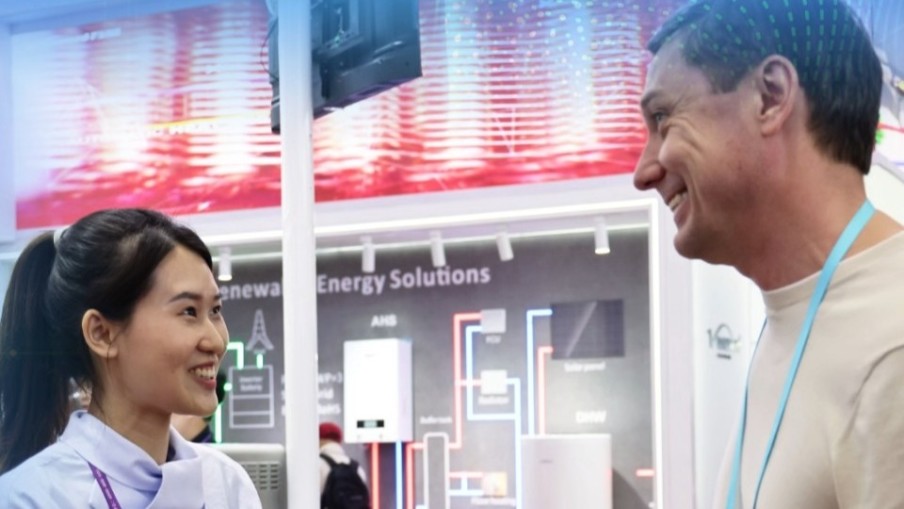

On April 23rd, the 135th Canton Fair Phase Ⅱ opened its doors, focusing on household items, gifts and decorations, building materials, and furniture. Jade, an Italian student from Guangdong University of Foreign Studies(GDUFS), was invited by "I See China," the international communication project of Yangcheng Evening News, to serve as a "China explorer." She explored exciting exhibits with reporters.