Chinese and US diplomats discussed the pandemic recently at their Anchorage meeting. As countries around the world continuously try to manage the effects of the pandemic, the US seems to have again, put its own interests before that of other countries. Earlier this month, the US House lawmakers gave final approval to a $1.9 trillion dollar coronavirus relief package. It is the latest measure in a series of monetary and fiscal policies enacted by the US Federal Reserve, injecting a huge amount of liquidity into its financial market.

Macroeconomics theory tells us that if a country prints too much money too fast, that country will end up with hyperinflation and currency depreciation, putting a heavy strain on its economy. So how is the US immune to this? The answer lies within the US dollar hegemony.

After WWI, the US dollar gradually became the de facto global currency. The Gold Standard was replaced by the Dollar Standard, and today, it is the most commonly held reserve currency and the most widely used currency for international trade and other transactions around the world, consolidating its supremacy.

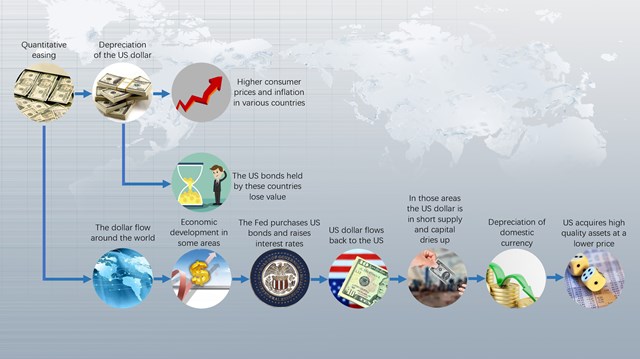

What this means is that, when the US Federal Reserve turns on its money printer, it creates a dominos effect. First, as supply increases, the Dollar depreciates, leading to an increase in consumer prices in other countries around the world. At the same time, the US bonds that these countries hold will decrease in value, effectively reducing the amount of debt owed by the US.

And then, as more dollars flow to the rest of the world through investment and trade, some countries and regions will experience short periods of economic growth. And this is when the US Federal Reserve will try to get some of that excess dollar back into its system, by buying back bonds and increasing its interest rates, causing these countries to experience a shortage of Dollars in reserve and a worsened investment climate, leading to a depreciation of their own currency, and that is when the US is able to purchase quality assets in these countries at a much lower price.

According to Morgan Stanley, the Biden administration’s plan will bring total US fiscal stimulus to fight the pandemic to more than $5tn USD. The Economist recently published an article warning against the “overheating” of the American economy, and the devastating effects that will create for other countries.

At a time when most countries in the world are struggling to regain their footing, the US is flooding the market with dollars to offload the stress on its own economy. How responsible is that?

Producer | Zhao Yang, Zheng Youzhi

Text | Qian Mingya Peng Yifei Zhao Yusheng

Translator / dubber | Zou Feixu

Video editing | Lizhuo, Zhang Yin

Presented by the International Communication Center of Nanfang Media Group