New quality productive forces a solution for China's continued growth: President of EuCham China

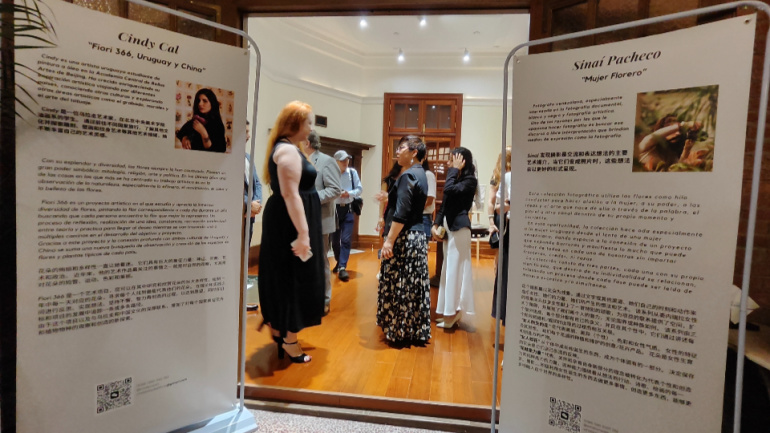

The European Chamber South China Chapter held the launch of the Chamber's latest report Riskful Thinking: Navigating the Politics of Economic Security, the European Chamber South China Chapter's Annual General Meeting and also the 2024 European Business in China Awards presentation on April 17.