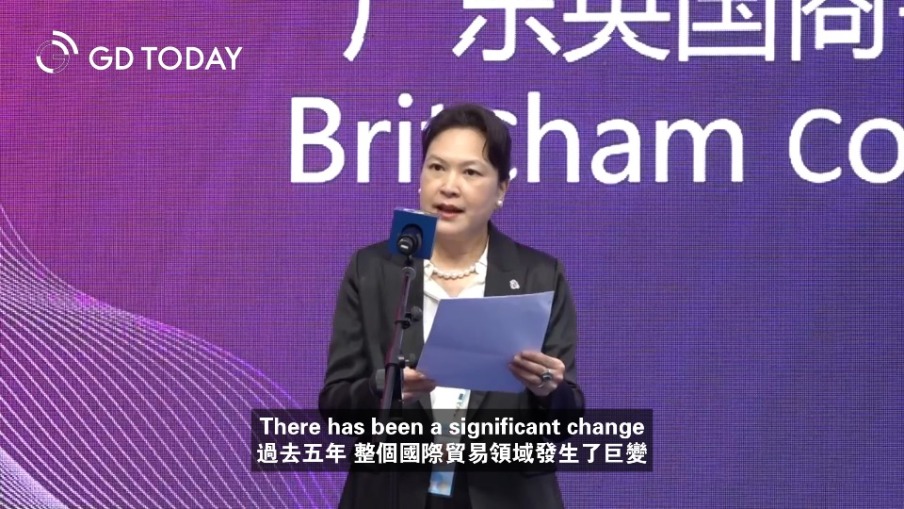

Canton Fair's pre-opening weekend: Foreign buyers go on a shopping spree in Guangzhou, new Chinese style in vogue | Minnie's Weekend

As the 135th Canton Fair opens, Minnie has been invited by Guangzhou Lanpu to attend the “Lan Yuan Sheng Hui - Blooming Yuexiu” cultural and tourism week series of events starting on April 13.