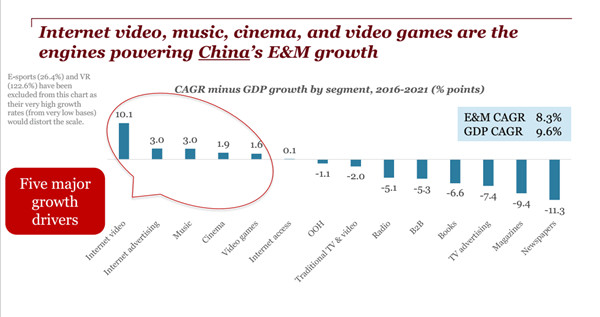

Over the next five years, China’s entertainment and media industry will grow at a compound annual growth rate (CAGR) of 8.3%, lagging behind a 9.6% growth of GDP CAGR, according to PwC’s Global entertainment and media outlook 2017-2021 released today (June 8).

To cope with the challenges of shifting consumption habits of content, companies must embrace technology to improve quality of content and create the most compelling user experience, according to the report.

In China, Mobile Internet advertising revenue will overtake wired internet advertising in 2019, an increase from US$15.4bn in 2016 to US$38.7bn in 2021. Total internet advertising revenue continues to grow at a 12.6% CAGR to reach US$68.0bn in 2021.

“Mobile advertising has huge growth opportunities in China, with social media being a key driver,” said Brian Choi, PwC China Entertainment and Media Partner. “Mobile advertising will continue to dominate internet advertising spend. ”

China’s total E&M revenue will rise at a CAGR of 8.3% over the coming five years (global figure is 4.2%). The report indicates that the engines powering China’s E&M growth is led by internet video, internet ads, music, cinema, and video games. During the course of 2016-2021, this will rise to a CAGR of 19.7%, 12.6%, 12.6%, 11.5% and 11.2% respectively.

In 2016, China’s total number of cinema screens exceeded those of the US. China had 41,056 cinema screens in 2016 compared to 40,928 in the US. The report forecasts that China will rank no.1 globally in the number of IMAX 3D screens by 2021, with 575 IMAX 3D screens to be built in China by 2021, up from 296 3D screens in 2016. A figure higher than anywhere else in the world.

Total Internet video revenue in China reached US$1.8bn in 2016. Total consumer spend on Internet video is forecast to reach nearly US$4.5bn in 2021.

“Over the next five years, China will witness a significant shift of viewing video content from free-to-air to paid video-on-demand service,” says Cecilia Yau, PwC Hong Kong Entertainment and Media Leader.

The report also shows that more companies are adopting emerging technologies to improve the user experience using Virtual reality (VR). In total, across the ten key markets considered, (USA, Japan, China, South Korea, UK, France, Germany, Russia, Italy, Spain) there will be 257mn VR headsets in the market by 2021. In China, around 85.9mn VR headsets will be in use by 2021 in comparison to 68mn in the US.