(Graphics/GT)

Pulling up stakes

Australia and New Zealand Banking Group (ANZ) has become the latest foreign bank to scale back its China presence by selling its stake in a Chinese lender. With the sale, ANZ has followed many foreign banks and financial institutions out of the Chinese mainland. Although many foreign banks have been unable to achieve their grand ambitions in China, experts said their investments in Chinese banks have turned out to be a good deal.

Australia and New Zealand Banking Group (ANZ) has become the latest foreign bank to sell off an investment in a Chinese bank.

The Australia-based bank announced on January 3 that it would sell its 20 percent stake in Shanghai Rural Commercial Bank Co to China COSCO Shipping Corp and Shanghai Sino-Poland Enterprise Management Development Corp for A$1.8 billion ($1.3 billion), Reuters reported on the same day.

ANZ Deputy Chief Executive Graham Hodges said that the sale reflects the bank's strategy to simplify its business and improve capital efficiency, according to the Reuters report.

There is a long list of foreign banks that have sold previously acquired stakes in Chinese banks over the last few years.

The sale of their minority stakes in Chinese banks by the likes of Bank of America Corp and Goldman Sachs Group Inc epitomizes the end of a "golden decade" in the Chinese banking sector as the country's economy downshifts, China Business News (CBN) reported on October 19, 2016.

Many foreign banks became equity investors of Chinese banks after 2005, when the latter underwent share structure reforms and began to seek listings on Hong Kong and mainland stock exchanges.

HSBC became the first foreign institutional investor in a Chinese bank in 2004 when it bought a 19.9 percent stake in Bank of Communications for 14.46 billion yuan ($2.09 billion).

Other foreign banks soon followed with similar investments. China, which opened its financial market to foreign banks in 2006 following its WTO commitment, has a 20 percent cap on single foreign investor ownership of a Chinese bank.

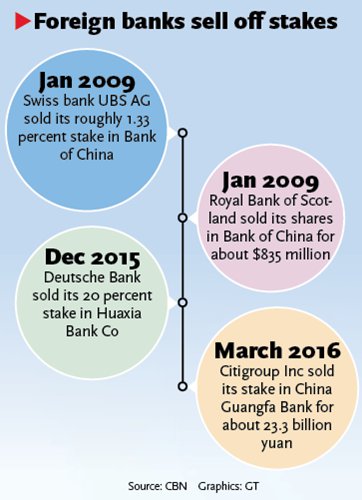

Following the global financial crisis in 2009, a succession of foreign banks began offloading their stakes. Since that year, seven global banks or financial institutions have sold their shares for cash, according to CBN.

In January 2009, Swiss bank UBS AG sold its stake in Bank of China to boost its capital. Also in January 2009, Royal Bank of Scotland sold its shares in Bank of China for $835 million in an effort to scale back its overseas investment.

In December 2015, Deutsche Bank sold its 19.99 percent stake in Huaxia Bank Co for some 23 billion yuan. In March 2016, Citigroup Inc sold its stake in Chinese regional lender China Guangfa Bank for about 23.3 billion yuan to China Life Insurance Co.

The end of an era

A banking analyst, who declined to be named, told the Global Times over the weekend that foreign financial institutions selling their stakes at Chinese banks is due in part to their weakened confidence in the mainland market.

The relationship has proved to be positive, the analyst said. By investing in Chinese banks, large global institutional investors such as HSBC made such investments more acceptable for global investors in general.

"However, while receiving dividends during a period of rapid growth of Chinese banks, foreign banks have had little impact on Chinese banks' governance," the analyst said. "In a nutshell, foreign banks gained much more than Chinese banks from their stakes."

Xi Junyang, a finance professor at the Shanghai University of Finance and Economics, said that the stake purchases taking place a decade ago were fueled by foreign banks' determination to expand into the Chinese market, and to exert influence with their expertise in operation concepts, methodology and management as strategic investors.

"However, as time went by, they found that their influence was limited to only technical aspects such as risk control and management, in contrast to the ambitions they once had," Xi said.

"The culture of Chinese banks, their management style and their relationship with the government is different than what foreign banks were used to," Xi told the Global Times on Sunday.

In the end, the foreign banks lost interest in remaining in China, Xi said.

Challenges outside China

"It is true that Chinese banks are facing mounting pressure in their operations, with the country's growth at its slowest in 25 years. The banking sector, which acts as the barometer for the economy, will bear the brunt of the slowdown," the analyst said.

Global rating agency Moody's said in a report on December 5, 2016 that the outlook for Chinese banking system is negative, due to the more challenging environment over the next 12 to 18 months, underlying growing worries over slowing economic growth, an increase in corporate mergers and high prices in certain assets.

With China's GDP growth rate forecast to slow further in 2017, the agency said credit growth will further drop, considering lackluster demand for corporate loans and the planned deleveraging the government is considering for the corporate sector.

These factors undermine the quality of bank assets, the stability of its capital, funding sources and liquidity, denting their profitability, the report said.

That being said, some foreign banks have sold their stakes in Chinese bank because of their own problems, the analyst said.

"For instance, Deutsche Bank sold its stake in Huaxia primarily because of its own operational losses, along with fines it was facing from US regulators, which forced the bank to sell assets to make ends meet," the analyst noted.

Xi agreed that foreign banks have been withdrawing from China mainly because of troubles outside the country following the global financial crisis.

He noted that the withdrawal, to a lesser degree, was connected to their less than successful expansions in China.

"Foreign banks are less familiar with the Chinese market than domestic banks, so they are less responsive to the demands of corporate and individual clients in China," Xi noted. "They try to apply their ubiquitous global business model to the Chinese reality, but get poor results. After an initial period of expansion, they are now receding."

A good deal

"It is a win-win relationship," Xi said. "Both foreign banks and Chinese banks benefited from the stake purchase, but thanks to their capital gains, it could be said foreign banks got a good deal. After all, profit is what matters most for banks."

Experts said some foreign banks did manage a measure of success in China because they are more flexible than their counterparts.

Singapore's DBS Group in October 10, 2016 boosted its Chinese branch's registered capital by 27 percent. On October 31, DBS announced it would acquire the wealth management and retail banking business of ANZ in five markets, including the Chinese mainland.