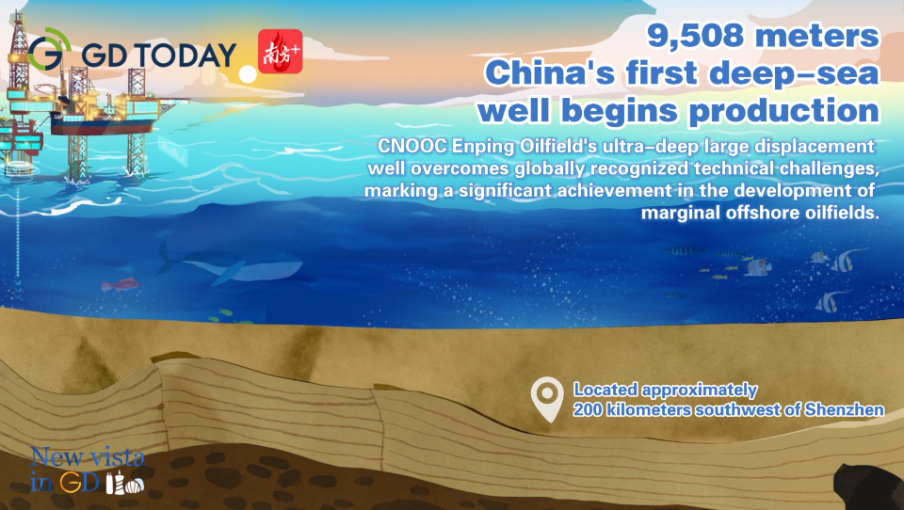

Discover incredible innovations just a step from our daily lives!

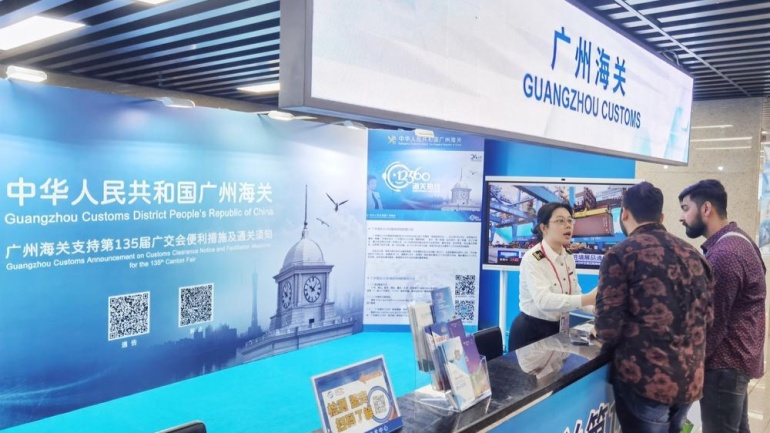

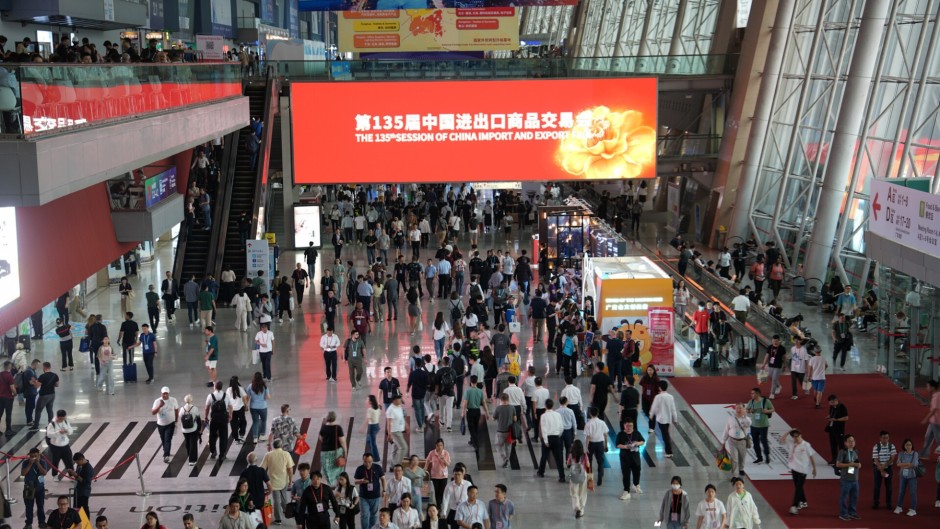

On April 15, 2024, the 135th Canton Fair officially opened. In this VLOG, Minnie experienced the "Advanced Manufacturing" exhibition area of this year's Canton Fair with the audiences.